The new UK alcohol duty legislation, due to come into effect on 1 August 2023, is intended to simplify the taxation system for companies producing or importing alcoholic beverages. This overhaul, which will affect beers, spirits, ciders, still and sparkling wines and other fermented beverages, is the most significant change since 1975 and ends a four-year alcohol duty freeze in place since February 2019.

So, what is changing?

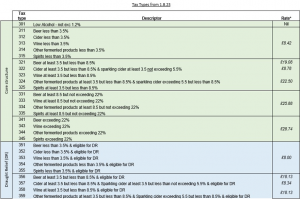

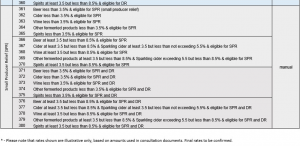

The taxation will now be calculated based on the litres of pure alcohol in the product rather than the beverage volume as before. By significantly reducing the number of tax bands, the government’s intention is to decrease administrative burdens for producers and promote healthier drinking habits.

Currently, only beer and spirits are taxed according to Alcohol By Volume (ABV), whereas duty on cider, wine, and fortified wine is based on the overall beverage volume. This has resulted in a complex banding system with a number of different tax rates for products with the same alcohol strength, which the new system looks to address.

The new system seeks to simplify rules for nearly all alcoholic beverages. Around 90% of all still wine products face a duty increase of at least 9%. This means that coupled with the lifted freeze, some wine importers face as much as a 20% tax increase. For example, duty on a bottle of still wine with 11.5-14.5% ABV will increase by 44p, and fortified wines like port with 20% ABV will see a hike of £1.30 per bottle.

However, not all prices are rising. The duty on a sparkling wine with 11.5-14.5% ABV will decrease, leading to a price drop of 19p for drinks like Prosecco or Champagne.

The duty change also benefits pub-goers. Draught beer and cider will see a decrease in duty due to an increased draught relief rate for venues, offsetting the standard alcohol duty by 9.2%. So, pub-goers will be able to enjoy a pint of beer at 11p less than if they purchased a beer with 4.5% ABV from a shop, where the price will rise by 4p per bottle.

As for spirits, a bottle of vodka with 37.5% ABV may see a price increase of 76p. Meanwhile, the duty on lower-strength drinks with 5% ABV will decrease by 14p.

Examples of old and new rates for still wine and sparkling wine

- Still wine per case/bottle – pre 1 August (calculated per litre) Per case (case of 6) 4.5 litres= Excise £13.39 per case/£2.23 per bottle

- Still wine per case/bottle – post 1 August (calculated per LOA) Per case (case of 6) 4.5 litres = Excise £16.03 per case/£2.67 per bottle

- Sparkling Wine per case/bottle – pre 1 August (calculated per litre) Per case (case of 6) 4.5 litres = Excise £17.15 per case/£2.86 per bottle

- Sparkling Wine per case/bottle – post 1 August (calculated per LOA) Per case (case of 6) 4.5 litres = Excise £16.03 per case/£2.67 per bottle

*All based on ABV% being 12.5%

Acknowledging the considerable impact these modifications will have on the wine industry, the government has put in place a transitional phase. Commencing on 1 August 2023 until 31 January 2025, all still and sparkling wines with an ABV ranging from 11.5% to 14.5% will use a standardised strength of 12.5% ABV when calculating duty to simplify the process.

The Government’s link: Alcohol Duty: rate changes – GOV.UK (www.gov.uk)