This month we are delighted to have two guest articles:

Soil Association – highlighting the new requirements from 2022 in importing Organic goods into the UK. Read the full post here

Peter Ward, United Kingdom Warehousing Association (UKWA) CEO: paints a picture of the current UK situation regarding warehousing and how to plan for any extra capacity you may need for Q4 to help build more resilience into your supply chains. Read the full blog post here

Regulations update and HMRC

Import model. From 1 July 2021, the UK will revert to its ‘Core’ import model. Businesses will be required to make declarations on all imports from the EU at the point of importation and pay the relevant tariffs to the UK border agency. Full safety and security declarations will be required, and physical border checks will be carried out. (Read a full technical update here)

Rules of Origin – The UK government has released a new video: (https://www.youtube.com/watch?v=0DT6CS6m9jU) covering Rules of Origin which is vital for your business. In line with this, there will be greater scrutiny from both UK and European customs towards the end of this year and into 2022.

We have moved and expanded

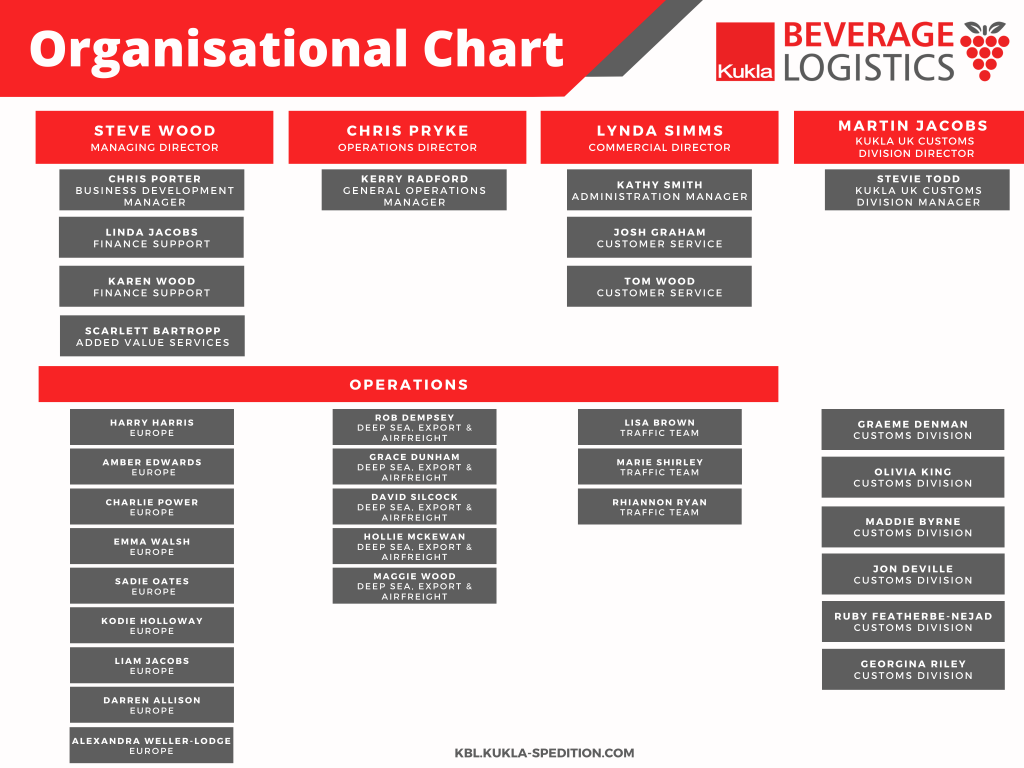

We have been on the move our Essex head quarters has moved to Fernwood House, The Hillway, Mountnessing, Brentwood, Essex CM15 0UE and our Customs Division has expanded in its current location. This is to help accommodate our new employees and allow for further growth. Below is our latest organisational chart.

Current situation update.

We are now midway through 2021 and the recent issues surrounding equipment availability and placement in EU regions impacting lead-times, collections and deliveries have changed little since our last bulletin. The key causes mentioned in May continue to affect the logistics sectors as we go through the summer:

- Import volumes are up and export volumes are still down

- Demand continues to outstrip supply

- A high percentage of import services operating as “unaccompanied” – i.e. driver in Europe trailers the container unit to port of exit to travel on the ferry “unaccompanied”. Once it arrives in UK the loaded unit is collected by a driver on UK trailer traction for the onward journey to final delivery point.

- European hauliers still remain reluctant to travel to the UK

- UK hauliers remain reluctant to travel to Europe

- Continuing delays to new customs clearance procedures and equipment availability as a result of some aspects of Brexit

- Subsequent adverse increase in time and cost impact to EU and UK haulage companies with Central Europe and France particularly affected.

Sea Freight

Recent news (June 1 onwards) is that Asia-Europe spot rates head for $20,000 per teu as new China Covid-19 crisis bites and this is a staggering increase of 1,000% on the spot rate for the trade just 12 months ago. We are becoming used to shipping containers being stockpiled at European and Chinese ports. This is a continuing issue and unlikely to be resolved in the short-term. This has caused a lack of containers on certain routes with demand outstripping supply.

Shippers are now facing what the logistics industry is calling “an era of unprecedented disruption.” The Chinese port of Yantian is currently experiencing a lengthy delay of vessels waiting to berth. It is estimated that the port’s productivity levels are just 45% of normal. This means there could be an average waiting time of 16 days before departure from the port – a significant time period that will affect schedules. This situation will also be compounded by increasing numbers of ‘blank sailings.’ There are also new Chinese port restrictions as a result of a recent outbreak of coronavirus at Guangdong. This has triggered a backlog in shipments affecting the ports of Yantian, Shekou, Chiwan, and Nansha.

Freight rates are also affecting North American sea routes. Some transatlantic shippers are seeing rate hike week-on-week increases. On 11 June the Freightos Baltic Index (FBX) North Europe to US component jumped 17%, to $5,069 per 40ft. According to The Loadstar media outlet, the FBX reading for the week commencing 14 June for Asia to North Europe climbed a further 5%. This means $10,998 per 40ft, although The Loadstar also reported that limited availability for UK delivery were around $16,000 per 40ft.

The continuing issue of limited availability will mean that once the Chinese ports have cleared their backlog, there will still be issues at US ports with rate hikes inevitable as container availability and sailings are limited.

European Freight

Kukla continues to offer customers solutions to the current supply chain disruptions. There is an increase in paperwork on both import and export routes and this has resulted in many European and UK owner-drivers and haulage companies still refusing to take export orders. We have been referencing this over the past few months and you need to plan for this in the longer term.

Kukla’s operations are being supplemented with a solution of local loadings for groupage in more depots across the EU regions, something we are still helping customers with. This will alleviate the threats of cancellations and late deliveries. Although lead-times are increased, our delivery performance from mainland Europe remains fluid and we continue to keep customers abreast of the current situation.

At the beginning of June media reports were highlighting the concerns that importers in Britain could be facing congestion at UK ports, particularly Felixstowe. As happened in 2020, this could see vessels from East Asia heading direct to European ports such as Antwerp or Rotterdam. This is another concern for UK importers.

Planning ahead – Summer Closures and Christmas 2021

Summer cellar closures in Europe are taking place and customers are looking at additional lead times. The current disruptions to supply chains are unlikely to recede in the next few months. Quarter four, this will require adjustments to your stock replenishment schedules to cover this period. This will inevitably lead to a demand for extra warehousing space (see the Peter Ward article at the beginning of the update). Christmas is technically over the horizon in terms of planning. This is the time to plan accordingly with the knowledge that supply chain disruptions will not be cleared before this period begins.