Sea Freight Update

Globally shipping is currently facing several challenges, one of the biggest of these being transit time. Global schedule reliability seems to continue to follow the historically low depths of 2021 levels according to the latest analysis from Sea-Intelligence. Alan Murphy, CEO of Sea-Intelligence, said in the firm’s report that in May 2022, schedule reliability of the world’s biggest carriers improved on April’s figures by 2.1 percentage points to 36.4 per cent. Reliability was down 2.3 percentage points compared to May 2021, however (read full story here https://www.porttechnology.org/news/schedule-reliability-remains-in-doldrums-as-maersk-shows-improvement/ )

Europe – Asia there is critical congestion in North Europe ports leading to the persistent unreliability of services (33,7% of vessels where on time in May according to Sea-Intelligence data). It is anticipated that there will be an acute capacity and equipment shortage when demand starts to increase towards the end of the year.

Europe to North America, spot rates are four times higher than last year and there is no sign of this changing on Westbound services. There are still blanked sailing due to congestion and other scheduling issues.

North America to Europe, there has been no significant increase in supply, so the situation remains the same. Spot rates are steady if we omit the increases caused by fuel prices.

West Coast the congestion has improved but the same cannot be said for East Coast where there has been a deteriorated especially at Houston and Savannah.

South Africa to UK, the situation has changed a lot, it is suffering from the shortage of containers especially 20ft ones in Cape Town and Durban. The ports in South Africa are experiencing the seasonal weather issues of very high winds affecting port operations, leading to lines amending where they are calling. It is expected that there will be no easing of the equipment issues going forward and it is anticipated that rates will continue to rise.

Oceania to Europe. Australia is continuing to see rates increasing especially as we are entering into the peak season for cotton and grain increasing the shortage of space. Also bunker costs are having a greater impact due to the long distances to cover on rates than other areas. Sydney is still seeing equipment shortages.

New Zealand is still experiencing delays or around a week and is also suffering from equipment shortages. There are some omissions by lines as they make scheduling changes to compensate for the delays.

South America to Europe – East Coast, demand is high, and rates are under pressure and it is predicted they will continue to rise. Most port are seeing issues of congestion and omissions though Burenos Aires is operating normally. West Coast San Antorio is being affected by bad weather conditions, delays though is seeing an improvement of equipment availability.

Rail Freight

With energy prices hitting new record highs in May, rail freight carriers face new challenges to keep their costs in check. Surcharges have become inevitable, efficiency is becoming the norm and in some countries, it is more attractive to run a diesel locomotive than an electric one. Read the full story here https://www.railfreight.com/specials/2022/06/03/energy-prices-reach-new-record-high-this-is-how-rail-freight-adapts/

Road Freight

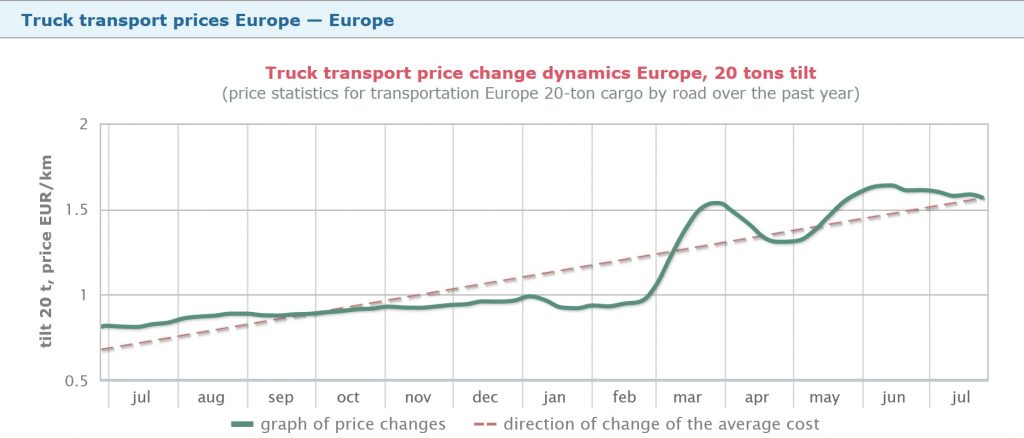

Rates though still high are stablising as shown below in chart from Della Trucking.

TI Road Freight Report

The latest Road Freight Report by Transport Intelligence has just been published the hightlights are below:

- The European road freight market grew 9.4% in real terms in 2021 (14.8% nominally) owing largely to Europe’s recovery from the COVID-19 pandemic.

- The market will expand by 4.9% in 2022 and is expected to be 6.3% larger in 2022 than it was in 2019.

- Recovery through to 2026 will remain positive, Ti data shows that the total European road freight market will see a real CAGR of 3.0% from 2021 to 2026.

- European road freight rates hit an all-time high in Q1 2022 as rising cost pressures, supply and capacity disruptions, regulatory change and war in Ukraine created a potent mix of rate drivers.

- Driver shortages remain an acute problem in the European market, with an overall shortage of 380,000-425,000 truck driver positions at the end of 2021.

- Funding continues to flow into digital forwarding start-ups that operate in the European road freight market. Capital flows towards later-stage companies and later-stage rounds, suggesting that later-stage companies will be faced with a more competitive funding environment.

Read more here