From 31 January 2025, all EU imports into Great Britain will require Safety and Security declarations. You can find a full list of countries this will apply to on GOV.UK.

Safety and Security declarations support the fight against illicit goods such as drugs and weapons entering the UK and make sure legitimate goods aren’t stopped for unnecessary checks.

Hauliers or carriers are legally responsible for submitting Safety and Security declarations. Further information on where liability sits for different transport modes can be found on GOV.UK.

HMRC are encouraging businesses to start submitting Safety and Security declarations now if they are ready to do so. They’re also reducing the amount of data required to make things easier for businesses.

If businesses are not ready, they should speak to their supply chains to check who is responsible and plan how declarations will be submitted.

If businesses do not submit S&S declarations on 31 January, they could be issued with a financial penalty, and goods could be held for unnecessary checks.

You can find more information on the new requirements by visiting GOV.UK.

UPDATE:

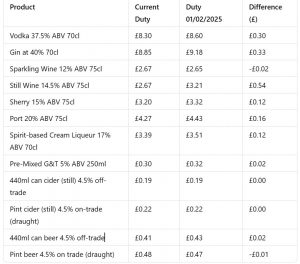

Following the UK Government’s announcement of alcohol duty changes and measures, the WSTA published a budget briefing summarising all relevant industry business policies. As a disclaimer, WSTA says, “Calculation of a per bottle or case rate is not, however, the correct process to calculate excise duty liability. The correct approach is to multiply the total volume of liquid released from duty suspense by ABV to achieve an lpa figure. This figure is then multiplied by the headline duty rate and rounded down to the nearest penny.”

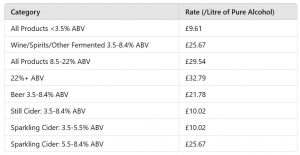

Duty changes and how they apply to each product based on alcohol percentage.

Duty Rates from 1 February 2025

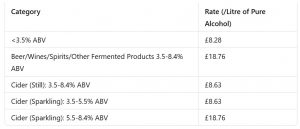

Draught Duty Rates

Modelling Wine 11-15% ABV

Products Modelling

Alcohol Duty rates last increased, in line with the Retail Price Index, on 1 August 2023 following an announcement at Spring Budget 2023. At Autumn Statement 2023, Alcohol Duty rates were frozen until 1 August 2024. This freeze was extended until 1 February 2025 at Spring Budget 2024. You can read more about the Policy paper on Alcohol Duty uprating – GOV.UK.

Photo credit: Pexels